Can I change leverage while trading?

Changing your trading account leverage is a powerful tool and one that may need to be changed from time to time based on your trading strategy. It affects the margin required to open a trade or maintain your positions. To change leverage go to the Account section in your secure client area.

What happens if I change leverage Mid trade?

You can change it by adjusting the leverage with the slider located on the left-hand side of the trading page. If you increase leverage, you reduce the amount of margin assigned to your position and that balance goes back to your “Available Balance”.

Can you change leverage on open position?

The leverage cannot be changed in an open position. You can only decide to apply leverage and how much to use when you are opening a new trade.

Does changing leverage affect profit?

Key Takeaways

Pip value is a measure that reflects how a one-pip change impacts a dollar amount and leverage is the amount of money you have available as a borrower. The more leveraged you are, the more risk you are facing; but on the flip side, the more leveraged you are, the greater the opportunity to profit.

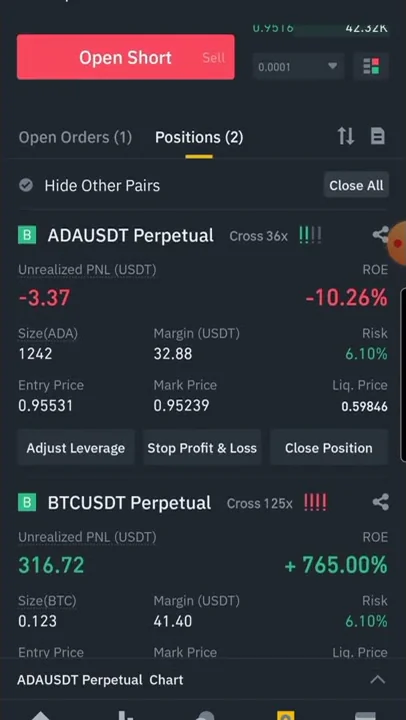

Can I adjust leverage during trade Binance?

You can adjust it in [Preference] - [Position Limit Enlarge]. Alternatively, you can access it via [Leverage] - [Adjust Margin] - [Position Limit Enlarge]. You can also access it via [Trading Rules] - [Leverage & Margin] - [Position Limit Enlarge].

Does higher leverage mean higher profit?

This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss. For example, if you have $10,000 in your account, and you open a $100,000 position (which is equivalent to one standard lot), you will be trading with 10 times leverage on your account (100,000/10,000).

What does it mean to adjust leverage?

Adjusted Leverage means, in respect of any period, the ratio of Total Net Debt on the last day of that period to Adjusted EBITDA in respect of that period.

How can you increase leverage?

You can thus use margin to create leverage, increasing your buying power by the marginable amount—for instance, if the collateral required to purchases $10,000 worth of securities is $1,000 you would have a 1:10 margin (and 10x leverage).

What happens if I increase leverage in Binance?

The higher the leverage, the smaller your volatility tolerance will be. Using lower leverage gives you more margin of error to trade. This is why Binance and other crypto exchanges have limited the maximum leverage available to new users.

How do you change leverage in Forex?

How do I change my account leverage or margin? Please fill out a Margin Change Request Form and submit it to global.support@forex.com.

What does 20x leverage mean?

The fact that you chose 20x in the menu only means that 20x is the maximum leverage you can get, and in this example, you can add up to $19k to your position size (or open other positions worth up to $19k).

What does 100x leverage mean?

With 100x leverage, $1 can be traded as $100, and traders can get all the benefits of the $100 so that their ROI(Return of Investment)can reach the highest. ADVERTIsem*nT. Let's use examples to help better understand 100x leverage. Assuming 1 BTC is used to open a long contract when Bitcoin is trading at $40,000.

Is leverage trading halal?

Yes, leverage trading is halal in Islam. Leverage is nothing more than employing debt to buy a security or implement an investment strategy. That said, the investment that the trading platform's leverage is being used for must be in compliance with Shariah. Overall, leverage trading is perfectly acceptable in Islam.

What happens if I increase leverage?

How Does High Leverage Impact Your Trades? Not only does leverage amplify your losses, but it also amplifies your transaction costs. The associated transaction costs of using high leverage can gradually drain your capital.

What is the best leverage for beginners?

What is the best leverage level for a beginner? If you are new to Forex, the ideal start would be to use 1:10 leverage and 10,000 USD balance. So, the best leverage for a beginner is definitely not higher than the ratio from 1 to 10.

How much leverage is safe?

As a new trader, you should consider limiting your leverage to a maximum of 10:1. Or to be really safe, 1:1. Trading with too high a leverage ratio is one of the most common errors made by new forex traders.

What leverage do professional traders use?

Many professionals will use leverage amounts like 10:1 or 20:1. It's possible to trade with that type of leverage, regardless of what the broker offers you. You have to deposit more money and make fewer trades.

Is High leverage bad?

A high debt/equity ratio generally indicates that a company has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the additional interest expense. If the company's interest expense grows too high, it may increase the company's chances of a default or bankruptcy.

What leverage is good for $100?

The best leverage for $100 forex account is 1:100.

Many professional traders also recommend this leverage ratio. If your leverage is 1:100, it means for every $1, your broker gives you $100. So if your trading balance is $100, you can trade $10,000 ($100*100).

What happens if you lose a leverage trade?

If the value of your position grows because of market movements, there is no issue. But if your position loses value to a point where you no longer meet minimum margin requirements, your broker will liquidate assets to help assure that you don't lose more money than you put into the account.

Why do brokers give leverage?

Brokers offer higher and higher leverage so that we can trade more and more so and they can make a lot of money since they earn money through brokerage only. However, small retail traders are known to have their accounts wiped out and all capital lost only because of being over-leveraged.

What does a leverage of 1 500 mean?

It represents something like a loan, a line of credit brokers extend to their clients for trading on the foreign exchange market. If brokers offer 1:500 leverage, this means that for every $1 of their capital, traders receive $500 to trade with.

Can I lose more money than I invest with leverage?

Leverage trading can be dangerous because it amplifies your potential investment losses. In some cases, it's even possible to lose more money than you have available to invest.

Does leverage increase risk?

Impact on Return on Equity

A company's return on equity increases at an optimum level of financial leverage because the use of leverage increases the stock volatility, increasing the level of risk which then increases the returns. Financially over-leveraged companies may face a decrease in return on equity.

What is a good leverage ratio?

A financial leverage ratio of less than 1 is usually considered good by industry standards. A leverage ratio higher than 1 can cause a company to be considered a risky investment by lenders and potential investors, while a financial leverage ratio higher than 2 is cause for concern.

References

- https://gloot.com/blog/outlands-news-2-secret-identities-family-drama-and-more

- https://www.seeker.com/how-much-of-the-internet-is-hidden-1792697912.html

- https://www.einvestigator.com/the-use-of-drones-in-law-enforcement-and-private-investigation/

- https://www.asuraworld.com/articles/How%20to%20Counter%20Seer%20in%20Apex%20Legends

- https://blog.imarticus.org/is-mathematics-required-to-implement-blockchain-solutions-in-business-fintech-blog/

- https://www.lawinsider.com/dictionary/adjusted-leverage

- https://gamerant.com/apex-legends-character-story/

- https://www.cnet.com/tech/services-and-software/what-would-it-take-to-beat-google/

- https://yourdronereviews.com/drones-for-law-enforcement

- https://www.dexerto.com/apex-legends/apex-legends-characters-age-history-1866017/

- https://www.investopedia.com/articles/personal-finance/042415/story-behind-googles-success.asp

- https://virgin-vs-chad.fandom.com/wiki/Wraith

- https://www.etoro.com/customer-service/help/1840362012/can-i-change-the-leverage-in-an-open-position/

- https://www.west-midlands.police.uk/frequently-asked-questions/police-drones

- https://escapethewolf.com/2296/when-you-under-physical-surveillance/

- https://www.thebalance.com/an-explanation-of-leverage-1344902

- https://www.careerera.com/blog/is-blockchain-a-good-career

- https://blog.prepscholar.com/what-comes-after-trillion

- https://blog.hubspot.com/marketing/top-search-engines

- https://www.ggrecon.com/guides/apex-legends-seer-abilities-lore/

- https://www.cbr.com/apex-legends-wattson-gibraltar-season-7/

- https://apexlegendsstatus.com/leaderboard/Seer/kills/1

- https://gamerant.com/apex-legends-characters-ranked-difficulty/

- https://www.radiusits.com/blog/microsoft-or-google/

- https://sureshotfx.com/best-leverage-for-100-forex-account/

- https://www.dexerto.com/apex-legends/best-legends-to-use-in-apex-legends-ultimate-tier-list-1194717/

- https://www.gadgetreview.com/how-far-can-military-drones-fly

- https://apexlegends.fandom.com/wiki/Seer

- https://www.comparably.com/blog/study-what-its-like-to-interview-amazon-apple-facebook-google-microsoft/

- https://www.rockpapershotgun.com/apex-legends-seer-abilities-tips-tricks

- https://www.investopedia.com/ask/answers/06/leverageandpipvalue.asp

- https://www.rockpapershotgun.com/best-apex-legends-characters-legend-tier-list-abilities-tips

- https://twitter.com/preslyy_/status/1552058876618428416

- https://www.dexerto.com/apex-legends/apex-legends-writer-reveals-new-lore-details-for-octane-mirage-1346714/

- https://www.trustedreviews.com/news/are-macs-safer-than-windows-laptops-4205593

- https://www.cnet.com/tech/services-and-software/googles-enemy-list-a-primer/

- https://www.impression.co.uk/blog/bing-differ-google/

- https://www.dictionary.com/browse/seer

- https://www.911security.com/en-us/knowledg-hub/drone-detection

- https://titanfall.fandom.com/f/p/3300297438920853131

- https://www.simplilearn.com/blockchain-programming-languages-article

- https://www.udacity.com/course/blockchain-developer-nanodegree--nd1309

- https://bitmex.freshdesk.com/en/support/solutions/articles/13000077797-how-do-i-add-margin-to-a-position-change-leverage-

- https://www.expressvpn.com/blog/4-ways-to-hide-from-drone-surveillance/

- https://www.springboard.com/blog/software-engineering/highest-paying-programming-jobs/

- https://bloodgoodbtc.medium.com/leverage-what-it-is-how-to-use-it-and-how-not-to-get-rekt-95954f0fef03

- https://www.cbr.com/apex-legends-lore-ships/

- https://www.insiderintelligence.com/content/google-remains-most-popular-us-search-engine

- https://www.forex.com/en/support/faqs/margin-and-leverage/

- https://mybabysittersavampire.fandom.com/wiki/Seer

- https://www.geeksforgeeks.org/different-job-roles-in-blockchain-technology/

- https://www.droneblog.com/drone-camera-distance/

- https://www.ambitionbox.com/salaries/microsoft-corporation-salaries

- https://www.droneblog.com/drone-looks-from-ground/

- https://support.google.com/assistant/thread/134740704/how-can-i-turn-on-google-asstistants-offensive-words?hl=en

- https://www.thegamer.com/apex-legends-character-roster-age-height-home-world/

- https://apexlegends.fandom.com/wiki/Pathfinder

- https://www.upgrad.com/blog/skills-needed-to-become-blockchain-developer/

- https://www.eff.org/deeplinks/2022/01/how-are-police-using-drones

- https://www.cnet.com/tech/services-and-software/bill-gates-defends-bing-and-windows-8/

- https://dotesports.com/apex-legends/news/best-legends-to-pair-with-seer-in-apex

- https://academy.binance.com/en/articles/what-is-leverage-in-crypto-trading

- https://www.hackreactor.com/blog/top-companies-paying-software-engineers-the-most-in-2022

- https://fifthperson.com/apple-vs-microsoft/

- https://panmore.com/google-swot-analysis-recommendations

- https://argoblockchain.com/articles/bitcoins-undeniable-mathematics

- https://nordvpn.com/blog/ios-vs-android-security/

- https://www.rockpapershotgun.com/apex-legends-next-character-seer-is-cursed-with-a-deadly-gaze

- https://lgbtqia-characters.fandom.com/wiki/Amity_Blight

- https://www.charlieintel.com/apex-legends-seer-lil-nas-x/119896/

- https://www.nytimes.com/1992/06/28/business/microsoft-s-unlikely-millionaires.html

- https://ntelt.cikd.ca/top-5-search-engines-used-in-daily-life/

- https://www.careerera.com/blog/which-is-better-blockchain-or-data-science

- https://gamerant.com/apex-legends-season-13-character-tier-list-newcastle/

- https://careerkarma.com/blog/how-to-get-a-job-in-blockchain/

- https://www.dorset.police.uk/support-and-guidance/safety-in-your-community/use-of-drones/

- https://www.investopedia.com/articles/forex/07/forex_leverage.asp

- https://seekingalpha.com/article/4550059-google-vs-microsoft-which-is-the-better-choice

- https://www.vocabulary.com/dictionary/seer

- https://www.oldest.org/entertainment/youngest-apex-legend-characters/

- https://www.binance.com/en/support/faq/13163f41fe2b44af982e612dfe7e6709

- https://www.washingtonpost.com/technology/2022/03/09/police-technologies-future-of-work-drones-ai-robots/

- https://www.thebalance.com/trading-using-leverage-1031047

- https://www.glassdoor.co.in/Compare/Apple-vs-Google-EI_IE1138-E9079.htm

- https://www.thegamer.com/apex-legends-seer-resurgence/

- https://seekingalpha.com/article/4523185-apple-vs-google-stock-clear-winner

- https://murder-mystery-2.fandom.com/wiki/Purple_Seer

- https://www.eurogamer.net/hands-on-with-wattson-the-newest-apex-legend

- https://www.businessinsider.com/25-giant-companies-that-earn-more-than-entire-countries-2018-7

- https://interestingengineering.com/culture/what-would-happen-if-google-suddenly-stopped-working

- https://www.ea.com/games/apex-legends/about/characters/wattson

- https://medium.com/blockworks-group/is-blockchain-better-than-a-database-d518743bdafa

- https://nocamels.com/2022/03/israel-see-through-wall-game-changer/

- https://www.binance.com/en/blog/futures/does-lower-leverage-make-better-sense-for-your-trading-421499824684902446

- https://www.upgrad.com/blog/prerequisites-to-learn-blockchain/

- https://www.bbc.co.uk/news/technology-12343597

- https://www.ign.com/wikis/apex-legends/Seer_Guide_and_Tips

- https://nordvpn.com/blog/private-search-engines/

- https://www.analyticsinsight.net/how-to-become-a-self-taught-blockchain-developer-and-earn-millions/

- https://en.wikipedia.org/wiki/Google_services_outages

- https://www.dexerto.com/apex-legends/how-to-play-seer-in-apex-legends-abilities-tips-more-1623325/

- https://apexlegends.fandom.com/wiki/Seer_(character)

- https://www.bbc.com/news/business-42060091

- https://scufgaming.com/gaming/apex-legends/apex-legends-character-tier-list-ranked

- https://www.statista.com/statistics/234529/comparison-of-apple-and-google-revenues/

- https://www.tutorialspoint.com/how-does-financial-leverage-affect-financial-risk

- https://www.dexerto.com/apex-legends/apex-legends-pro-albralelie-explains-why-seer-is-gaming-breaking-in-current-meta-1875899/

- https://california.universitypressscholarship.com/view/10.1525/california/9780520252295.001.0001/upso-9780520252295-chapter-8

- https://dronesgator.com/how-to-see-a-drone-at-night/

- https://www.ggrecon.com/guides/apex-legends-seer-nerf/

- https://en.wikipedia.org/wiki/Don%27t_be_evil

- https://www.droneblog.com/how-to-spot-a-drone-at-night-things-to-look-for/

- https://dronesgator.com/can-drones-see-inside-your-house-through-walls-or-curtains/

- https://afkgaming.com/esports/guide/seer-vs-bloodhound-who-is-the-better-recon-legend

- https://answers.ea.com/t5/Bug-Reports/Seer-s-tactical-and-Lifeline-s-revive/td-p/10572346

- https://www.eurogamer.net/apex-legends-seer-abilities-explained-launch-skins-list-8022

- https://california.universitypressscholarship.com/view/10.1525/california/9780520252295.001.0001/upso-9780520252295-chapter-2

- https://www.forbes.com/sites/theyec/2019/01/29/looking-to-get-into-blockchain-here-are-four-ways-to-get-involved/

- https://www.investopedia.com/terms/l/leverage.asp

- https://www.esportstales.com/apex-legends/characters-official-ages

- https://apexlegends.fandom.com/wiki/Gibraltar

- https://twitter.com/fanbytemedia/status/1100173821733203968

- https://www.gamespot.com/articles/seer-guide-apex-legends/1100-6494808/

- https://www.dexerto.com/apex-legends/seer-heirloom-apex-legends-1973778/

- https://www.tradingpedia.com/leverage-1500-forex-brokers/

- https://www.litefinance.com/blog/for-beginners/forex-leverage/best-leverage/

- https://cultofdrone.com/drone-laws-in-the-uk/

- https://www.simplilearn.com/tutorials/blockchain-tutorial/how-to-become-a-blockchain-developer

- https://www.eccouncil.org/programs/blockchain-certification-courses/

- https://www.businessinsider.in/stock-market/top-market-cap-companies-in-the-world/slidelist/93952579.cms

- https://www.zdnet.com/article/best-browser-for-privacy/

- https://dronesgator.com/can-drones-hear-conversations/

- https://www.dexerto.com/apex-legends/imperialhal-explains-why-seer-is-broken-and-makes-apex-legends-easy-mode-1848499/

- https://apexlegends.fandom.com/wiki/Seer/Voice_lines

- https://dronereviewsplace.com/how-far-can-drones-go/

- https://vikings.fandom.com/wiki/The_Seer

- https://www.indeed.com/companies/compare/Google-vs-Microsoft-d5cd619626c9f6f7-e3a48f8a4a788271

- https://apexlegends.fandom.com/wiki/Fuse

- https://answers.ea.com/t5/General-Discussion/Seer-or-crypto-who-s-currently-the-better-legend/td-p/10911131

- https://hired.com/job-roles/blockchain-engineer

- https://en.wikipedia.org/wiki/List_of_largest_companies_by_revenue

- https://www.investopedia.com/news/public-private-permissioned-blockchains-compared/

- https://www.computerworld.com/article/2492642/microsoft-s-office-365-home-premium-to-cost--99-99-annually-per-subscription.html

- https://www.zdnet.com/article/office-365-vs-g-suite-which-productivity-suite-is-best-for-your-business/

- https://www.polygon.com/22638438/apex-legends-update-patch-notes-seer-nerf-passive

- https://gloot.com/blog/apex-legends-how-to-really-pick-your-main

- https://screenrant.com/why-the-seer-really-licked-flokis-hand-in-vikings-season-4/

- https://murder-mystery-2.fandom.com/wiki/Random_Painted_Seers

- https://www.gamespot.com/articles/apex-legends-seer-can-see-heartbeats-farther-than-he-can-hear-them/1100-6494593/

- https://www.mcafee.com/en-in/safe-browser.html

- https://bettermarketing.pub/how-tiktok-overtook-google-as-the-worlds-most-popular-website-d0fc79853c0a

- https://blockchaintrainingalliance.com/blogs/news/the-5-highest-paying-blockchain-jobs-in-2022

- https://dotesports.com/apex-legends/news/everything-we-know-about-seer-in-apex-legends

- https://coptrz.com/blog/drone-solutions-for-police-how-are-the-police-using-drones/

- https://faculty.math.illinois.edu/~castelln/prillion_revised_10-05.pdf

- https://www.visualcapitalist.com/ranked-the-most-valuable-brands-in-the-world/

- https://www.911security.com/en-us/knowledge-hub/drone-detection/radar

- https://screenrant.com/vikings-show-seer-hand-lick-characters-reason-explained/

- https://www.gamespot.com/articles/apex-legends-season-15-launch-trailer-reveals-catalyst-and-seer-have-some-serious-beef/1100-6508472/

- https://www.dexerto.com/apex-legends/seer-sees-apex-legends-pick-rate-collapse-after-major-nerfs-1641013/

- https://tvtropes.org/pmwiki/pmwiki.php/Main/BlindSeer

- https://tracker.gg/apex/leaderboards/stats/all/SeasonWins

- https://www.droneblog.com/drone-following-me/

- https://www.inverse.com/gaming/apex-legends-season-10-seer-release-date-abilities-story-voice-actor-gameplay

- https://www.wisestamp.com/blog/gmail-vs-outlook/

- https://www.droneblog.com/i-just-found-a-drone-what-should-i-do-with-it/

- https://pepperstone.com/en/support/how-can-i-change-the-leverage-on-my-trading-account/

- https://gloot.com/blog/apex-legends-everything-you-need-to-know-about-bloodhound

- https://murder-mystery-2.fandom.com/wiki/Seer

- https://dronereviewsplace.com/why-are-drones-following-me/

- https://science.howstuffworks.com/drone-spying.htm

- https://hr.lib.byu.edu/00000179-1484-d8b8-a1fd-5496279e0000/werewolf-game

- https://www.myboosting.gg/blog/apex-legends/apexlegends-romances-relationships

- https://fitsmallbusiness.com/g-suite-vs-office-365/

- https://apexlegends.fandom.com/wiki/Revenant

- https://www.oberlo.com/blog/top-search-engines-world

- https://www.babypips.com/learn/forex/more-on-leverage

- https://en.wikipedia.org/wiki/Apple_Computer,_Inc._v._Microsoft_Corp.

- https://www.trcconsulting.org/blog/all-about-leverage-in-stock-trading

- https://www.ambitionbox.com/profile/blockchain-developer-salary

- https://en.wikipedia.org/wiki/Microsoft

- https://www.indiatimes.com/technology/news/microsoft-beats-apple-to-become-worlds-most-valuable-company-again-552916.html

- https://www.dualshockers.com/roblox-murder-mystery-2-mm2/

- https://blog.prepscholar.com/googol-googolplex

- https://www.dexerto.com/apex-legends/which-characters-are-lgbtqia-in-apex-legends-1569544/

- https://seekingalpha.com/article/4542480-google-vs-tesla-which-stock-better-forecast

- https://gloot.com/blog/apex-legends-lifeline-the-combat-medic

- https://www.techtarget.com/whatis/definition/googol-and-googolplex

- https://gamerant.com/apex-legends-seer-tips-guide/

- https://www.statista.com/statistics/216573/worldwide-market-share-of-search-engines/

- https://www.dexerto.com/apex-legends/apex-legends-octane-seer-season-15-map-teaser-1964285/

- https://www.simplilearn.com/how-to-start-a-career-in-blockchain-technology-article

- https://www.dailyforex.com/a/community/islam/is-leverage-trading-halal-in-islam

- https://www.inc.com/jt-odonnell/6-reasons-working-at-google-isnt-right-for-most-people.html

- https://computersciencehero.com/careers/blockchain-developer/

- https://www.heliguy.com/blogs/posts/five-ways-police-are-using-drones

- https://liquipedia.net/apexlegends/Portal:Statistics

- https://www.investopedia.com/terms/l/leverageratio.asp

- https://www.dronerush.com/best-long-range-drones-18975/

- https://www.caa.co.uk/consumers/remotely-piloted-aircraft/general-guidance/reporting-misuse-of-a-unmanned-aircraft-and-drones/

- https://www.linkedin.com/pulse/why-blockchain-jobs-careers-future-jesse-anglen

- https://dronereviewsplace.com/why-are-there-drones-in-the-sky-at-night/

- https://www.upgrad.com/blog/top-10-highest-paying-jobs-in-india/

- https://www.dexerto.com/apex-legends/apex-legends-dev-confirms-time-is-coming-for-major-seer-nerfs-2000288/

- https://www.coursera.org/collections/learn-blockchain

- https://www.comparitech.com/privacy-security-tools/blockedinchina/bing/

- https://phys.org/news/2010-02-internet-sites-google-people-smarter.html

- https://www.glassdoor.com/Compare/Microsoft-vs-Google-EI_IE1651-E9079.htm

- https://finance.yahoo.com/news/bexplus-announces-100x-leverage-100-190500079.html

- https://www.dexerto.com/apex-legends/apex-legends-devs-explain-no-seer-nerfs-despite-dominance-1938472/

- https://www.fool.com/the-ascent/small-business/accounting/articles/financial-leverage/

- https://afkgaming.com/esports/news/tsm-imperialhal-hits-number-1-predator-on-apex-legends

- https://www.thestar.com/business/opinion/2022/02/19/google-search-has-gotten-worse-heres-the-trick-people-have-found-to-get-around-it.html

- https://www.macrotrends.net/stocks/charts/SEER/seer/net-worth

- https://www.cnet.com/tech/tech-industry/artificial-intelligence-is-no-smarter-than-a-six-year-old-study-says/

- https://www.knowledgehut.com/blog/blockchain/programming-language-for-blockchain-development

- https://www.blockchain-council.org/blockchain/java-or-python-which-suits-blockchain-better/

- https://www.xdynamics.com/blog/how-far-can-a-drone-fly/

- https://www.gamespot.com/articles/apex-legends-stories-from-the-outlands-explains-why-lifeline-traded-family-for-a-punk-band/1100-6504588/

- https://www.dexerto.com/apex-legends/all-apex-legends-heirlooms-how-to-get-heirloom-shards-1510719/

- https://www.blockchain-council.org/blockchain/how-can-a-newbie-start-learning-about-blockchain/

- https://apexlegends.fandom.com/wiki/Valkyrie

- https://www.upgrad.com/blog/is-blockchain-a-bright-career-opportunity-for-non-techies-too/

- https://www.cnbc.com/2015/01/16/forex-leverage-how-it-works-why-its-dangerous.html

- https://www.esportstales.com/apex-legends/most-played-characters-and-tier-list

- https://www.dexerto.com/apex-legends/wattson-players-call-for-buff-in-apex-legends-to-counter-seer-1625363/