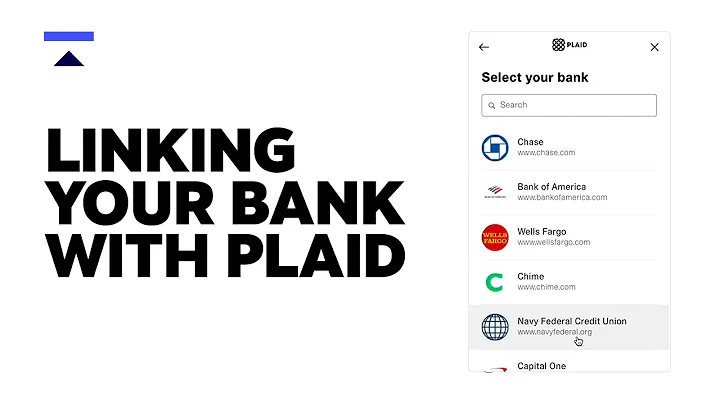

How do I manually link my bank account to Plaid?

- Log in to your Uphold account.

- In the Settings section, select “funding methods”

- Select “Add bank account” and choose “Use bank login credentials”

- Review the Plaid requirements and select “Continue”

How do I manually enter bank information on Plaid?

Access Manual Add Button: In the 'Select your bank" search bar, type the word manual or your bank institution. Next, press "Link with account numbers," even if the logo for your bank displays. Then, follow the prompts provided by Plaid to connect your account manually.

Why can't I link my bank account using Plaid?

Plaid isn't integrated with your financial institution. Plaid can't reliably connect to your financial institution right now. Some financial institutions may not let you connect your accounts to third-party apps. You can link your account manually.

What do I do if my bank isn't on Plaid?

If your bank isn't listed on Plaid, that is no problem. You can connect by entering in your account and routing number by choosing the manual connection option right underneath the Plaid option. Connecting manually requires micro deposit identify verification.

Where can I link my bank account without verification?

- Paypal.

- Cash App.

- Venmo.

- Popmoney.

- Samsung Pay.

- Apple Pay.

- Gcash.

How do I verify my bank with Plaid?

- Step 1: Click on the arrow next to profile and select "Billing Information" from the drop-down menu.

- Step 2: Click on the "Edit Bank Account" button.

- Step 3: Click on the "Verify Instantly with Plaid" button.

- Step 4: Click on the "Continue" button.

- Step 5: Search for or select your bank.

How do I link my current account to Plaid?

- When linking your Current Account, search Current in Plaid.

- Enter your phone number (with or without dashes) and a 7 digit code will be sent via SMS.

- Enter this code. A screen should appear with your active accounts.

- Select your Individual Current Account.

Which banks does Plaid support?

- Ally Bank.

- Discover.

- Fifth Third Bank.

- Huntington Bank.

- KeyBank.

- M1 Finance.

- Mos.

- Navy Federal Credit Union.

Why is Plaid saying my bank info is wrong?

The login and password associated with your financial institution may have changed. To solve this problem, first verify your login and password on your financial institution's website, then go back into the app and try reconnecting your accounts.

Why does Plaid say account not currently supported?

Common causes

The institution does not support one of the products specified in Link initialization. The institution is associated with a country not specified in Link initialization. The institution is associated with a country your Plaid account hasn't been enabled for.

Can you bypass Plaid?

You can easily opt out of Plaid in the app. Here's how to get started: From the Home screen, tap your account icon in the top left corner. Tap on Personalization & Data below Privacy & Legal.

Does Plaid work with Cash App?

Plaid is a booming platform with more than one million dollars worldwide. Thanks to its level of trust and security in the market, it serves to connect with applications such as Cash App or Peer to Peer (P2P). Plaid is aligned with over 3,000 banks, credit unions, and other financial services.

How long does it take Plaid to verify your bank account?

The Automated Micro-deposit flow

The Automated Micro-deposits authentication flow is supported for ~1,100 financial institutions in the US only. Plaid will make a single micro-deposit and then automatically verify it within one to two business days.

How do I link my Cash App to my bank account without Plaid?

- Select the “Banking” tab.

- Tap “Add Bank” or “Linked Accounts” if you already have an account linked.

- A debit card option will appear.

- Enter your debit card details.

- Complete the confirmation process.

What can I pay with my account and routing number?

You can often use your routing and account numbers to pay for things online or to send money to other people through various digital payment services. You can also use them to sign up for direct deposit through many employers or through other institutions that pay out money like the Social Security Administration.

How can I get money using account and routing number?

It is straightforward to transfer money with your routing and account number, and the process will generally be as follows: You must be logged into your online account. Go to the money transfer section. Enter the recipient's details, including routing and account number.

How can I verify my bank account?

Call the Customer's Bank

Ask the agent what information the bank needs for verification. This is typically the customer's full name, address, and routing and account numbers as they appear on the check. The routing number, which identifies the bank, is the first set of numbers in the bottom left corner of the check.

Should I give Plaid my bank login?

Plaid uses the highest levels of security possible to keep your information safe. When you link your checking account with a financial application through Plaid, the company instantly encrypts sensitive data and shares it with the application using a secure connection.

Has Plaid ever been hacked?

But considering that the company has not been hacked and no data have been leaked, I'd have to say that… Yes, plaid is safe… so far. I have to point out though that the company has recently faced a lawsuit over the alleged collection of more information than what was needed.

How do I link my Wells Fargo account to Plaid?

- Navigate to your Control Tower in your account.

- Click on Connected Apps.

- Look for "Plaid"

- In the Plaid selection, select all checkboxes.

- Click on Save.

What companies work with Plaid?

Venture capital-backed Plaid links your bank account to fintech apps like Venmo, Robinhood, Coinbase, Betterment and Acorns.

How many banks does Plaid integrate with?

Plaid currently supports over 2000 financial institutions, and they're continuously working on adding more. If your bank does not appear in the list, there may be two reasons why: Your bank is not supported by Plaid.

Does Plaid work with PayPal?

Plaid, one of our third party connectors, can help you get your expenses automatically imported from your bank accounts, credit cards, and PayPal accounts (Crypto, Investment, Loan and Line of Credit accounts will not be imported).

Can you bypass Plaid?

You can easily opt out of Plaid in the app. Here's how to get started: From the Home screen, tap your account icon in the top left corner. Tap on Personalization & Data below Privacy & Legal.

How do you get past the Plaid on the Cash App?

However, there are ways to bypass Plaid on Cash App if you'd rather not use it or manually enter your banking routing number, bank name and address, username, and password. Manually link your bank account or use your debit card to link your bank account instead of using Cash App without Plaid.

References

- https://news.microsoft.com/stories/people/cortana.html

- https://www.facebook.com/Halo/videos/todayinhalo-2552-the-original-noble-six-thom-a293-sacrifices-his-life-in-a-battl/708318289709002/

- https://www.vocabulary.com/dictionary/bishop

- https://www.cryptovantage.com/news/is-ledger-still-safe-everything-we-learned-from-last-years-hack/

- https://www.superjeweler.com/blog/the-sideways-cross-necklace-symbolism-with-style

- https://venturebeat.com/games/the-deanbeat-halo-4-is-the-romance-of-master-chief-and-cortana-disguised-as-a-combat-game/

- https://gocardless.com/guides/posts/the-difference-between-available-and-ledger-balance/

- https://sirusgaming.com/what-is-the-weapons-name-in-halo-infinite/

- https://www.kiplinger.com/slideshow/business/t043-s010-air-force-one-over-the-years/index.html

- https://www.investopedia.com/news/bitcoin-safe-storage-cold-wallet/

- https://www.ledger.com/academy/what-happens-if-i-lose-my-ledger

- https://www.investopedia.com/terms/l/ledger-balance.asp

- https://originstamp.com/blog/here-is-why-bitcoin-transactions-take-so-long/

- https://www.ledger.com/academy/calculate-your-crypto-taxes

- https://support.current.com/hc/en-us/articles/5358814544283-How-do-I-link-my-Current-Account-through-Plaid-

- https://www.nike.com/a/how-to-uncrease-shoes

- https://medium.com/voice-tech-podcast/siri-alexa-cortana-and-why-all-boats-are-a-she-e4fb71b6a9f7

- https://www.sagu.edu/thoughthub/cherubim-the-ox-lion-eagle-and-man/

- https://www.halopedia.org/Atriox

- https://www.ledger.com/what-are-the-differences-between-cold-storage-wallets-and-ledgers-hardware-wallets

- https://support.ledger.com/hc/en-us/articles/360000380313-Manage-your-private-keys-own-your-crypto

- https://alexaanswers.amazon.com/question/79mSBIn8bzCxNntzWrLl8z

- https://smallbusiness.chron.com/check-bank-account-validity-45521.html

- https://www.thegamer.com/halo-what-happened-cortana/

- https://www.halopedia.org/Battle_of_Miridem

- https://www.investopedia.com/ledger-nano-s-vs-x-5188903

- https://www.diocesepb.org/about-us/bishop/symbols-of-a-bishop/symbols-of-a-bishop.html

- https://help.withyotta.com/en/articles/4498790-i-can-t-find-my-bank-to-connect-what-do-i-do

- https://www.thebalancemoney.com/funds-available-315426

- https://worldpopulationreview.com/country-rankings/largest-air-forces-in-the-world

- https://gamerant.com/halo-master-chief-cortana-how-many-days-together/

- https://support.ledger.com/hc/en-us/articles/360002731113-Update-Ledger-Nano-S-firmware

- https://halofanon.fandom.com/wiki/Cortana_(Novum_Acies)

- https://www.thecryptomerchant.com/blogs/resources/what-is-ledger-live-and-how-does-it-work

- https://support.ledger.com/hc/en-us/articles/4404382560913-Restore-your-Ledger-accounts-with-your-recovery-phrase

- https://support.sendwyre.com/hc/en-us/articles/360055319474-Why-is-my-bank-account-not-listed-

- https://www.chess.com/forum/view/general/can-a-pawn-promote-to-a-bishop-of-same-color

- https://captainaltcoin.com/multiple-hardware-wallets/

- https://www.ledger.com/blog/ledger-live-introducing-floating-swap-rate

- https://www.sellerapp.com/blog/amazon-unavailable-balances/

- https://en.wikipedia.org/wiki/Confirmation_in_the_Catholic_Church

- https://support.freshbooks.com/hc/en-us/articles/360033417072-How-do-I-set-up-a-Bank-Connection-with-Plaid-

- https://support.ledger.com/hc/en-us/articles/360019387637-Resetting-your-Ledger-Live-password

- https://www.allaboutanthony.com/air-force-1-popular/

- https://www.sapling.com/13712949/how-to-withdraw-money-with-an-account-and-routing-number

- https://www.allaboutcareers.com/student-finance/cash-app/bank-cash-app-on-plaid/

- https://catholictimescolumbus.org/news/the-catholic-times/bishop-s-clothing-displays-tradition-symbolism

- https://support.ledger.com/hc/en-us/articles/4404389367057-Is-my-Ledger-device-genuine-

- https://www.outlookindia.com/business-spotlight/ledger-nano-s-review-is-this-cryptocurrency-hardware-wallet-safe-shocking-alert--news-225511

- https://www.investopedia.com/ledger-nano-s-review-5190302

- https://www.bungie.net/en/Forums/Post/2446279

- https://plaid.com/docs/auth/coverage/automated/

- https://en.wikipedia.org/wiki/Pectoral_cross

- https://www.inverse.com/gaming/halo-infinite-ending-explained-harbinger-endless-atriox-escharum

- https://support.microsoft.com/en-us/topic/changes-to-cortana-in-2020-and-2021-2d04871e-f576-7080-58b4-7c37131c3baf

- https://www.halopedia.org/The_Weapon

- https://www.hammondandharperoflondon.com/why-the-white-collar/

- https://en.wikipedia.org/wiki/Air_Force_(shoe)

- https://en.wikipedia.org/wiki/Hand-kissing

- https://www.allaboutcareers.com/student-finance/transfer-funds-with-routing-an-account-number/

- https://support.ledger.com/hc/en-us/articles/360014053240-Use-Ledger-Live-on-multiple-devices

- https://www.facebook.com/www.adusmalawi.org/posts/why-does-a-bishop-remove-his-mitre-chisoti-during-some-parts-of-the-massafter-th/1634876583311895/

- https://www.adaptworldwide.com/insights/2021/gender-bias-in-ai-why-voice-assistants-are-female

- https://oefederal.org/fraudandsafety/plaid/

- https://support.ledger.com/hc/en-us/articles/360012207759-Solve-a-synchronization-error

- https://www.complex.com/sneakers/2017/01/nike-air-force-1-history

- https://www.wikihow.com/Spot-Fake-Nikes

- https://solecollector.com/sd/00527/nike/nike-air-force-1-low

- https://www.quora.com/What-is-the-difference-between-the-Air-Force-One-and-the-Air-Force-One-07

- https://comicbook.com/gaming/news/halo-master-chief-makee-paramount-plus/

- https://www.mercyhome.org/blog/sunday-mass/reflections/priests-father/

- https://en.wikipedia.org/wiki/Monsignor

- https://www.halopedia.org/Seven

- https://support.avail.co/hc/en-us/articles/236155927-Connect-a-bank-account-without-entering-an-online-banking-password

- https://villains.fandom.com/wiki/Cortana

- https://www.britannica.com/topic/miter

- https://decider.com/2022/03/31/halo-paramount-plus-jen-taylor-interview-cortana/

- https://www.chess.com/forum/view/general/why-the-bishop-has-notch-on-its-head

- https://www.thecompassnews.org/2020/08/why-a-bishop-always-wears-a-cross/

- https://retirepedia.com/how-to-send-money-from-bank-account-without-verification.html

- https://forums.halowaypoint.com/t/cortana-purple-to-blue-evil-to-friend-wtf/492271

- https://www.nike.com/air-force-1

- https://www.ledger.com/academy/enter-the-trust-zone/losing-your-ledger

- https://www.ledger.com/academy/can-i-recover-my-hot-wallet-on-a-ledger

- https://www.halopedia.org/Cortana

- https://support.microsoft.com/en-us/topic/control-your-smart-home-devices-with-cortana-14497f85-555b-3d1f-2f1b-afe99ef17ed9

- https://www.sneakerjagers.com/en/n/the-10-most-popular-nike-air-force-1s-at-stockx/30080

- https://www.britannica.com/topic/zucchetto

- https://www.aaplautomation.com/tally_img/1473507316Merging%20Ledger.pdf

- https://halo.fandom.com/wiki/Cortana

- https://www.forbes.com/sites/zacharysmith/2022/04/27/boeing-ceo-regrets-deal-with-trump-for-new-air-force-one-jets-that-will-cost-company-1-billion/

- https://www.episcopalchurch.org/glossary/episcopal-ring/

- https://www.benzinga.com/money/ledger-wallet-review

- https://www.holyart.com/blog/religious-items/the-meaning-of-the-mitre/

- https://support.ledger.com/hc/en-us/articles/4404389482641-Add-your-accounts

- https://en.wikipedia.org/wiki/Clerical_collar

- https://gamerant.com/halo-infinite-weapon-cortana-ai-comparison/

- https://en.wikipedia.org/wiki/4

- https://plaid.com/institutions/

- https://community.lwolf.com/s/article/LWBC-Adjust-the-Commission-Ledger-Balance-for-a-Deal

- https://en.wikipedia.org/wiki/Jen_Taylor

- https://www.slsupplyco.com/blogs/sneakers/how-to-spot-fake-air-force-1-your-must-know-guide-to-fake-sneakers

- https://support.uphold.com/hc/en-us/articles/360033539932-My-bank-account-is-manually-linked-How-do-I-link-it-using-Plaid-

- https://www.thegamer.com/halo-infinite-unanswered-questions-after-ending/

- https://www.okta.com/identity-101/cached-data/

- https://www.loyolapress.com/catholic-resources/scripture-and-tradition/catholic-basics/catholic-beliefs-and-practices/marks-of-the-church

- https://www.hbgdiocese.org/wp-content/uploads/2014/03/What-a-Bishop-Wears-Bishop-Gainer.pdf

- https://www.smithsonianmag.com/air-space-magazine/first-air-force-one-180974937/

- https://www.ledger.com/ledger-live

- https://www.firstrepublic.com/insights-education/what-does-ledger-balance-mean

- https://support.ledger.com/hc/en-us/articles/4402577950225-Wrong-portfolio-or-asset-value-in-Ledger-Live

- https://www.alphr.com/coin-not-showing-trust-wallet/

- https://plaid.com/trouble-connecting/

- https://en.wikipedia.org/wiki/Mitre

- https://support.ledger.com/hc/en-us/articles/4410960111889-Update-Ledger-Live-

- https://support.ledger.com/hc/en-us/articles/360020849134-Track-your-transaction

- https://foreverwingman.com/air-force-female-dress-and-appearance-your-faqs-answered/

- https://thesporting.blog/blog/nike-air-force-one-a-history

- https://support.ledger.com/hc/en-us/articles/360019095214-Reset-to-factory-settings

- https://support.google.com/googlepay/answer/10206607?hl=en

- https://www.onmsft.com/news/cortana-nude-halo-franchise-director-frank-oconnor-explains

- https://www.gamespot.com/articles/why-halo-tv-series-changed-cortana-look/1100-6501529/

- https://plaid.com/docs/link/troubleshooting/

- https://www.thegamer.com/halo-infinite-new-cortana-ai-weapon/

- https://en.wikipedia.org/wiki/Deubr%C3%A9

- https://support.ledger.com/hc/en-us/articles/360021488913-Connect-Ledger-Nano-S-to-your-phone

- https://www.catholic.com/qa/why-do-bishops-and-cardinals-wear-skullcaps

- https://charlieintel.com/how-old-is-master-chief-in-halo-infinite/144267/

- https://www.thecompassnews.org/2020/12/why-do-some-bishops-wear-amethysts/

- https://www.creditkarma.com/money/i/current-balance-vs-available-balance

- https://www.sothebys.com/en/articles/the-40-year-anniversary-of-the-air-force-1

- https://gamerant.com/cortana-naked-halo/

- https://en.wikipedia.org/wiki/Episcopal_gloves

- https://www.learnreligions.com/christianity-symbols-illustrated-glossary-4051292

- https://www.ledger.com/ledger-nano-s-ledger-live-mobile-compatibility-now-available-for-android-users

- https://aviation.stackexchange.com/questions/24653/what-is-this-on-top-of-the-air-force-one

- https://support.ledger.com/hc/en-us/articles/4404382258961-Install-uninstall-and-update-apps

- https://www.investopedia.com/terms/l/ledger-wallet.asp

- https://www.syncgene.com/webhelp/Content/How_long_does_it_take.htm

- https://help.braid.co/en/articles/5953142-how-to-link-your-wells-fargo-account

- https://forums.halowaypoint.com/t/the-encyclopedia-on-why-cortana-went-evil/514199

- https://sneakernews.com/2022/01/21/best-selling-sneakers-of-2021/

- https://www.ledger.com/phishing-campaigns-status

- https://juno.finance/blog/current-balance-vs-available-balance

- https://www.britannica.com/topic/crosier-religion

- https://www.4af.afrc.af.mil/

- https://harcourts.com/blog/the-meaning-behind-different-colours-of-clergy-shirts/

- https://aleteia.org/2019/02/22/why-do-bishops-have-a-special-chair/

- https://www.britannica.com/topic/cross-religious-symbol

- https://www.ledger.com/academy/how-can-you-sign-online-transactions-when-your-private-key-is-offline

- https://frugalreality.com/cash-app-works-with-plaid-link/

- https://www.qrcode-tiger.com/nike-qr-code

- https://www.crockford.org.uk/faq/how-to-address-the-clergy

- https://www.one37pm.com/style/how-to-spot-fake-sneakers

- https://iohk.zendesk.com/hc/en-us/articles/360010554794-Why-does-it-take-so-long-to-sync-my-Daedalus-Wallet-

- https://support.ledger.com/hc/en-us/articles/115005198525-Transaction-stuck-in-pending-

- https://en.wikipedia.org/wiki/Clerical_clothing

- https://people.howstuffworks.com/air-force-one4.htm

- https://www.allthingssecured.com/reviews/security/is-plaid-safe-to-use/

- https://www.investopedia.com/terms/a/available-balance.asp

- https://support.collectiveshift.io/en/articles/5164322-how-do-i-use-my-ledger-without-ledger-live

- https://support.ledger.com/hc/en-us/articles/360015216913-Frequently-asked-questions

- https://en.wikipedia.org/wiki/Zucchetto

- https://www.halopedia.org/Roland

- https://koinly.io/integrations/ledger/

- https://www.sneakerfreaker.com/features/sneaker-anatomy-101

- https://support.ledger.com/hc/en-us/articles/360007646053-Use-multiple-Ledger-devices

- https://www.allaboutanthony.com/which-air-force-1-should-i-get/

- https://www.thegamer.com/halo-master-chief-body/

- https://en.wikipedia.org/wiki/Ecclesiastical_ring

- https://www.princegeorgecountyva.gov/news_detail_T6_R2139.php

- https://support.ledger.com/hc/en-us/articles/4404381846929-Clear-cache-in-Ledger-Live

- https://www.cnbc.com/2018/10/04/meet-the-startup-that-powers-venmo-robinhood-and-other-big-apps.html

- https://en.chessbase.com/post/endgame-blog-karsten-mueller-922e

- https://en.wikipedia.org/wiki/Tippet

- https://ask.stash.com/ask/opt_out_of_plaid/

- https://abcnews.go.com/Health/Pope/story?id=640088&page=1

- https://www.nbcnews.com/tech/mobile/why-microsoft-named-its-siri-rival-cortana-after-halo-character-n71056

- https://fabrikbrands.com/nike-logo-history-and-evolution/

- https://www.indystar.com/story/news/politics/2017/10/16/inside-air-force-two-pences-plane-more-than-decent-ride-but-not-quite-air-force-one/761139001/

- https://www.bbc.co.uk/bitesize/guides/zc668mn/revision/1

- https://www.sofi.com/learn/content/current-balance-vs-available-balance/

- https://www.ledger.com/swap-ripple

- https://nativenewsonline.net/advertise/branded-voices/what-is-ledger-live-crypto-swap-how-can-i-use-it

- https://blog.finishline.com/history-of-nike-air-force-1/

- https://www.indystar.com/story/news/politics/2017/10/16/6-fun-facts-air-force-two/762010001/

- https://executiveflyers.com/does-air-force-one-have-weapons/

- https://en.wikipedia.org/wiki/Cortana_(Halo)

- https://www.post-gazette.com/sports/steelers/2022/09/10/steelers-black-air-force-energy-shoes-2022-mike-tomlin-najee-harris/stories/202209100039

- https://www.farfetch.com/style-guide/street-style/air-force-1-sizing-and-fit-guide/

- https://gamerant.com/halo-master-chief-vs-noble-6-best-spartan/

- https://www.hellotravel.com/stories/top-10-strongest-air-forces-of-world

- https://www.detroitcatholic.com/news/the-meaning-behind-a-bishop-s-adornments

- https://solesavy.com/nike-air-force-1-retail-price-increase-from-90-to-100/

- https://support.ledger.com/hc/en-us/articles/4406118184721-Add-a-new-Ledger-device-to-Ledger-Live

- https://www.ledger.com/sell-bitcoin

- https://www.ledger.com/ledger-live-feature-focus-real-time-balances-and-multi-currencies

- https://www.seattletimes.com/entertainment/tv/seattle-actor-jen-taylor-reprises-role-of-the-ai-cortana-on-paramount-halo-series/

- https://www.bungie.net/en/Forums/Post/2519929

- https://thesolesupplier.co.uk/news/how-does-the-nike-air-force-1-shadow-fit-and-is-it-true-to-size/

- https://support.ledger.com/hc/en-us/articles/4402560627601-Why-is-my-deposit-or-transaction-not-showing-in-Ledger-Live-

- https://www.ledger.com/academy/how-crypto-gets-stolen-and-how-to-avoid-it

- https://www.ledger.com/swap

- https://www.ledger.com/academy/selling-crypto-how-and-why-does-one-do-it

- https://support.ledger.com/hc/en-us/articles/360020773319-What-s-new-in-Ledger-Live-

- https://simpleflying.com/inside-air-force-one/

- https://www.shoepalace.com/blogs/all/the-history-of-the-nike-air-force-1

- https://www.exercise.com/support/plaid-bank-account-verification/

- https://www.bridgeportdiocese.org/why-do-bishops-wear-a-hat-and-carry-a-stick/

- https://www.bankrate.com/glossary/z/zero-balance/

- https://en.wikipedia.org/wiki/Master_Chief_(Halo)

- https://learn.g2.com/what-is-cached-data

- https://catholicdos.org/symbols-of-the-bishop

- https://www.imdb.com/name/nm2782926/news

- https://www.inverse.com/gaming/halo-infinite-ending

- https://www.dexerto.com/tv-movies/what-is-article-72-in-halo-tv-series-1828084/

- https://www.hammondandharperoflondon.com/clerical-collars-symbolism-and-meaning/

- https://support.ledger.com/hc/en-us/articles/115005165269-Fix-USB-connection-issues-with-Ledger-Live

- https://unhalo.fandom.com/wiki/Noble_Six

- https://www.allaboutanthony.com/do-nike-shoes-last-long/

- https://support.ledger.com/hc/en-us/articles/360013349800-Update-Ledger-Nano-X-firmware

- https://www.merriam-webster.com/dictionary/bishop

- https://www.chausa.org/publications/health-progress/article/september-october-2005/the-role-of-the-bishop

- https://www.thecompassnews.org/2021/08/whats-that-on-bishops-head/

- https://gaming.stackexchange.com/questions/218893/are-cortana-and-master-chief-in-love

- https://www.halopedia.org/Logic_plague

- https://www.ign.com/wikis/halo-infinite/Legendary_Ending_Differences

- https://www.catholiceducation.org/en/culture/catholic-contributions/symbols-of-the-office-of-bishop.html

- https://www.oklahomacentral.creditunion/Current-Balance-vs-Available-Balance